MOST ELECTRIC

VEHICLES ARE

CHEAPER TO OWN

OFF THE LOT THAN

GAS CARS

ROBBIE ORVIS

MAY 2022

EXECTUIVE SUMMARY

Many studies show electric vehicles (EVs) are cheaper to

operate than gasoline-powered vehicles with lower total cost

of ownership (TCO) over the vehicle lifetime, due to fuel and

maintenance savings outstripping purchase price differences.

However, most consumers focus on how much they’ll have to

pay to own and operate a vehicle each month, not necessarily

how much a vehicle will save them over its lifetime. And

roughly half of Americans think EVs are too expensive to

consider or aren’t willing to pay more for an EV compared to

a gasoline car.

This research finds that in most states, financing and owning

an EV is cheaper on a monthly basis than financing and

owning an equivalent gasoline car.

In other words, most new EVs are cheaper to own from the

day they are driven off the lot, even when the sticker price is

considerably higher. Consumer savings are even greater if the

EV incentives currently proposed in Congress are included,

making EVs cheaper in nearly every instance, and more

affordable for all Americans looking to purchase a new car.

Since 85 percent of new vehicle buyers finance their cars,

understanding how the monthly loan repayment compares to

estimated fuel and maintenance costs is critical to

understanding the monthly impact to consumers.

This study compares monthly ownership costs of six EV and

gasoline equivalent vehicles, accounting for financing costs,

www.energyinnovation.org

98 Battery Street, Suite 202

San Francisco, CA 94111

2

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

state taxes and fees, state and federal rebates and tax credits, fuel costs, maintenance costs, and insurance

costs. For two of the vehicle comparisons we evaluated, the Hyundai Kona SEL and the Ford F-150, the EV

version was cheaper to own per month in every single state.

For several others, including the Volvo XC40, the Nissan Leaf (compared to the Nissan Versa), and the

Hyundai Kona Limited, it was cheaper to own the EV version in about half of states. Where those models

did cost more, it was often by less than $15 per month. For one model, the Kia Niro, the EV was only cheaper

in a handful of states, due largely to the fact that the hybrid gasoline version achieves 50 miles per gallon.

While monthly EVs costs during loan repayment are lower in many states, savings grow dramatically after

the loan is repaid, with nearly every state-vehicle comparison showing significant monthly cost savings, in

line with other studies. Our modeling finds that TCO is significantly lower for EVs than for gasoline cars,

with owners saving on average $6,000 over the vehicle’s lifetime. Though we did not explicitly look at the

used car market, used cars have a lower purchase price (though higher financing rates), and cost savings

are likely to be even more advantageous for EVs, especially if Congress passes a used EV tax credit.

These monthly savings are contingent on the existing $7,500 federal EV tax credit. Without this tax credit,

most models are no longer cheaper during the loan repayment period (even though operating costs and

TCO remain lower than for gasoline cars). Notably, two of the vehicle manufacturers we evaluated in this

study, Ford and Nissan, will likely exceed the federal tax credit cap of 200,000 EV sales this year, meaning

the tax credit will unlikely last at current levels beyond 2022 without a modification to current policy.

Our modeling shows that increasing the tax credit amount as currently proposed in Congress, significantly

improve EV ownership economics, with a $10,000 tax credit making EVs cheaper in nearly every state-

vehicle comparison. The tax credits take on even greater significance if gas prices decline, because the

operating cost difference will shrink. These findings underscore why Congress must pass an extended and

expanded EV tax credit in the coming months, or risk backsliding on EV deployment and consumer savings.

INTRODUCTION

EVs are an increasingly economic choice for consumers worried about pain at the pump. Many studies

show EVs can save owners thousands of dollars relative to gasoline vehicle equivalents over a vehicle’s

lifetime.

1

,

2

,

3

,

4

,

5

,

6

TCO are considerably lower due to fuel and maintenance savings from driving an EV relative

to a gasoline vehicle. Fuel savings accrue because EVs are two to four times more efficient than gasoline

vehicles, so driving the same distance costs considerably less, and have fewer moving parts requiring less

maintenance than gasoline vehicles. Indeed, numerous studies demonstrate considerable operational

savings from driving an EV.

Despite these savings, customers may be dissuaded from purchasing an EV because of higher upfront costs

(though upfront EV costs, despite near-term supply chain challenges, are expected to reach price parity

with gasoline vehicles in the mid-2020s)

7

, especially when state and federal rebates and tax credits are not

clearly articulated to potential consumers. This sticker shock may discourage consumers from purchasing

EVs, even when it is in their economic interest, given that TCO and operating costs are consistently lower

for EVs than gasoline cars: A Cox Automotive study found that 51 percent of Americans believe EVs are

“too expensive to seriously consider,”

8

and nearly half of Americans aren’t willing to pay more for an EV

than a gasoline car.

9

However, while EVs have higher upfront prices today than comparable gasoline cars, very few people pay

for their new cars upfront: More than 85 percent of new vehicle purchases are financed,

10

creating a

3

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

payment stream over several years (six years is the most common lease term).

11

Ultimately, consumers are

focused on how much their monthly costs will change as a result of a new vehicle purchase. TCO and

operational savings are often too intangible to overcome concerns about upfront purchase price

differences.

This study evaluates monthly ownership costs of EVs compared to gasoline vehicle equivalents, including

the cost of paying back vehicle financing. We include financing costs, taxes, rebates and tax credits, state

fees, fuel costs, maintenance costs, and insurance costs. We selected six different EV-gasoline comparisons,

identifying vehicles that are as similar as possible. This is challenging as many base EV models have more

advanced features than equivalent base gasoline models. More information on the selected vehicles and

methodology used to estimate monthly vehicle ownership costs is discussed below.

METHODOLOGY

We estimate the monthly and annual vehicle ownership costs over the loan repayment period to evaluate

monthly EV ownership costs when the vehicle is purchased. We include purchase, financing, insurance,

fuel, and maintenance costs, as well as state rebates and federal tax credits.

Vehicle Purchase Costs

We collected data on vehicle prices from manufacturer websites for six gasoline vehicles and six EVs, for

six direct comparisons. We selected models reflecting the range of vehicle types on the market (e.g.,

compact, crossover, pickup, and SUV). Base model EVs often have more features than comparative base

model gasoline cars. We assessed model variants to identify the closest comparison between gasoline and

electric versions of vehicles with the closest matching set of features.

EPA Size Class

Gasoline Model

MSRP

EV Model

MSRP

Small SUV

Hyundai Kona SEL

$24,745

Hyundai Kona Electric SEL

$35,245

Small SUV

Hyundai Kona Limited

$29,845

Hyundai Kona Electric

Limited

$43,745

Standard Pickup

Truck

Ford F-150 XL

$31,685

Ford F-150 Lightning Pro

$41,669

Small Station

Wagon

Kia Niro EX Premium

$33,600

Kia Niro EV EX Premium

$45,865

Small SUV

Volvo XC40 Inscription

$41,945

Volvo XC40 Recharge Plus

$56,395

Compact/Midsize

Nissan Versa S Xtronic

CVT

$17,875

Nissan LEAF

$28,425

Table 1: Selected 2022 Gas and EV Models and MSRP used in this study

Financing Costs

Total financed amounts include state tax for each vehicle, accounting for states with discounted EV sales

taxes, and subtracting the estimated down payment using the national average from J.D. Power of 12

percent per vehicle, for gasoline vehicles.

12

For EVs, we assume the same down payment as the gasoline

equivalent as a conservative estimate, increasing monthly loan repayment costs for EVs but providing an

apples-to-apples comparison of upfront costs. Annual financing charges are then estimated using the total

4

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

financed amount, the national average new vehicle loan term of six years as reported by Edmunds, and a

financing rate of 3.86 percent, which is the 2021 national average reported by NerdWallet.

We also include estimated state rebates and federal tax credits for EVs. Currently, all the evaluated models

qualify for the $7,500 federal tax credit, though beginning in 2023 at least two of the vehicles will likely lose

their tax credits unless Congress passes legislation extending existing credits or adding new ones.

13

State

rebates are often applied at the point of sale or within several months following the vehicle purchase. The

federal tax credit is received during tax filing for the year the vehicle is purchased (e.g., for a consumer

purchasing an EV in 2022, the tax credit wouldn’t be received until taxes are filed in 2023). For simplicity,

we levelize tax credits over the loan term. We sum the financing charges, inclusive of state taxes and down

payments, then apply rebates and tax credits to determine annual financing charges, as shown in Figure

1.

14

,

15

It is worth noting some manufacturers and dealers offer different financing rates for different vehicle types,

which this analysis does not consider. For example, Nissan offers 3.39 percent financing

16

for the Versa S

Xtronic CVT but 0.9 percent financing

17

for a LEAF purchase, a difference of around $400 per year

depending on state tax rates and available rebates. Different available financing rates could considerably

impact annual financing costs and is an important policy consideration.

Operating Costs

Maintenance Costs

We estimate annual operating costs, including fuel and maintenance. For maintenance costs, we use U.S.

Department of Energy (DOE) data on estimated maintenance costs per mile by vehicle type.

18

This analysis

found that monthly maintenance costs for EVs ($0.061/mile) are roughly 40 percent lower than those for

gasoline cars ($0.101/mile). Annual maintenance costs are estimated using per-mile estimates from DOE

and estimated average annual mileage of 13,469 over the loan term using data from the U.S. Environmental

Protection Agency’s (EPA) MOVES3 model.

19

Fueling Costs

Vehicle fueling costs are estimated using annual mileage, fuel efficiency from FuelEconomy.gov, current

average state gasoline prices from AAA as of May 4

th

, 2022

20

and 2021 average residential electricity rates

for EVs. It is important to note EPA’s fuel efficiency values reflect tested values, and that on-road efficiency

is typically lower than rated values.

For EVs, we assume owners use Level 1 chargers. Although a high percentage of current EV owners have

installed Level 2 chargers,

21

data on average daily driving distance and Level 1 charging speed finds the vast

Where:

i

= Average vehicle loan APR

n

= Average loan term

MSRP

= Manufacturer’s suggested retail price

Figure 1: Formula for Calculating Annual Financing Charge

2

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

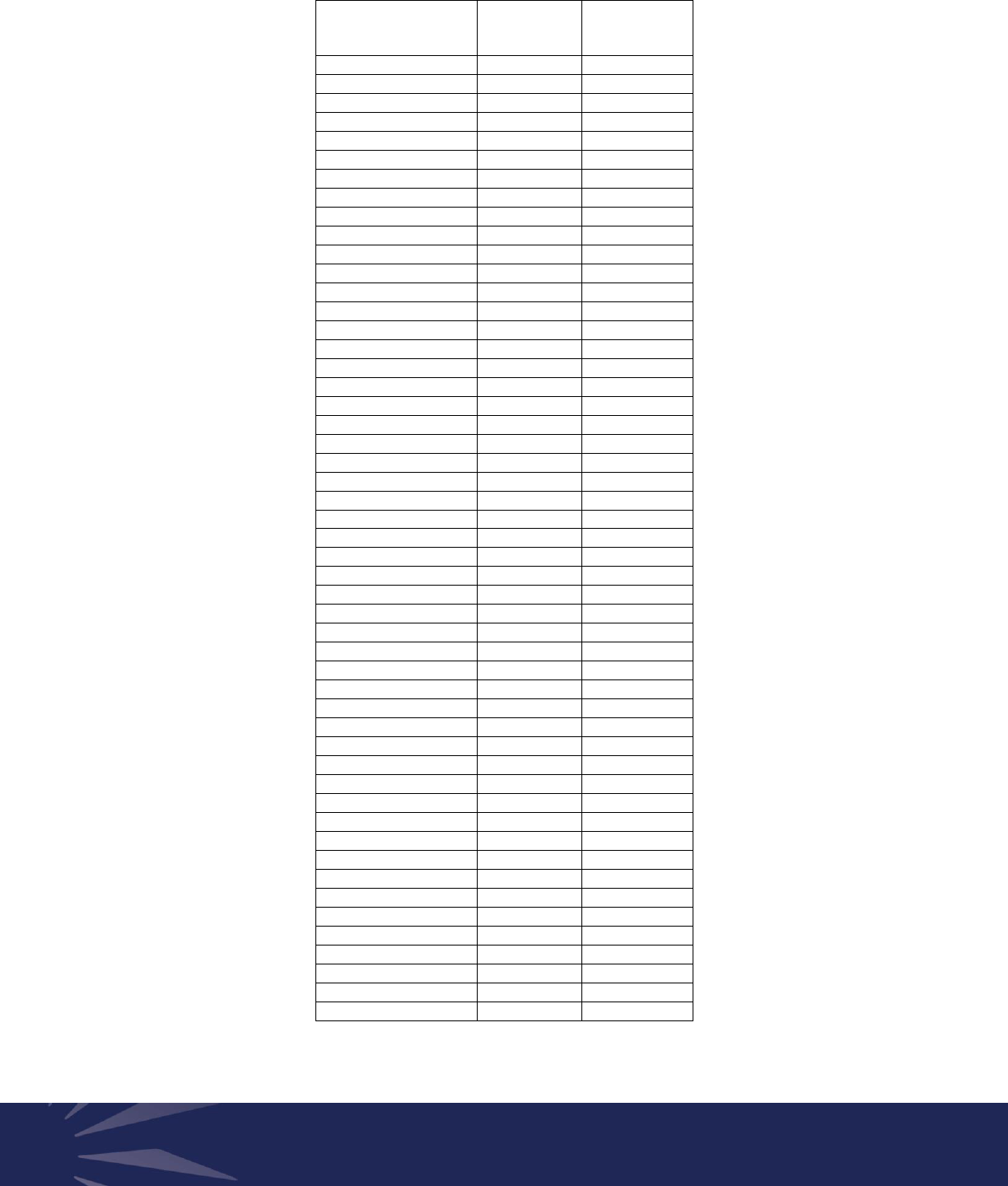

State

State

Electricity

Price ($/kWh)

State Regular

Gasoline Price

($/gal)

Alabama

$0.13

$3.88

Alaska

$0.23

$4.68

Arizona

$0.13

$4.59

Arkansas

$0.11

$3.82

California

$0.23

$5.76

Colorado

$0.13

$4.04

Connecticut

$0.22

$4.17

Delaware

$0.13

$4.26

District of Columbia

$0.13

$4.53

Florida

$0.12

$4.18

Georgia

$0.13

$3.75

Hawaii

$0.33

$5.27

Idaho

$0.10

$4.46

Illinois

$0.13

$4.52

Indiana

$0.13

$4.12

Iowa

$0.13

$3.92

Kansas

$0.13

$3.82

Kentucky

$0.12

$3.88

Louisiana

$0.11

$3.89

Maine

$0.17

$4.26

Maryland

$0.13

$4.27

Massachusetts

$0.23

$4.24

Michigan

$0.18

$4.28

Minnesota

$0.13

$3.91

Mississippi

$0.12

$3.82

Missouri

$0.11

$3.82

Montana

$0.11

$4.18

Nebraska

$0.11

$3.95

Nevada

$0.12

$5.10

New Hampshire

$0.20

$4.17

New Jersey

$0.16

$4.28

New Mexico

$0.14

$4.11

New York

$0.19

$4.38

North Carolina

$0.12

$3.96

North Dakota

$0.11

$3.97

Ohio

$0.13

$4.02

Oklahoma

$0.12

$3.84

Oregon

$0.11

$4.71

Pennsylvania

$0.14

$4.40

Rhode Island

$0.22

$4.22

South Carolina

$0.13

$3.89

South Dakota

$0.12

$4.03

Tennessee

$0.11

$3.96

Texas

$0.12

$3.88

Utah

$0.11

$4.51

Vermont

$0.19

$4.29

Virginia

$0.12

$4.08

Washington

$0.10

$4.74

West Virginia

$0.12

$4.07

Wisconsin

$0.15

$3.99

Wyoming

$0.11

$4.17

Table 2: Gasoline Prices as of May 4, 2022 and 2021 State Electricity Rates

3

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

majority of daily driving needs can be met without Level 2 chargers. For example, the average single-car

American household drives about 30 miles per day.

22

Level 1 chargers can charge about five miles per

hour,

23

meaning just six hours of charge each day with a Level 1 charger could recharge an EV for an average

daily drive. Even on a day with double the average distance, a 12-hour overnight charge would be sufficient.

And since most drivers park their cars for more than six hours a day (e.g., overnight), any shortfall in battery

charge could be made up by subsequent charging sessions.

Maintenance and fuel costs are added together to estimate annual operating costs:

Insurance Costs

Insurance costs (premiums) are based on many factors, but vehicle price is arguably the most important.

Data on rates by vehicle types also suggest EVs receive a slightly higher rate even when vehicles are similarly

priced (a variety of potential reasons exist for this trend). We estimated the difference in insurance

premiums for different vehicle types using data from MoneyGeek.com. Using data provided on insurance

premiums across several different gasoline and EV models, we estimate insurance premiums for the models

covered in this study as a function of MSRP and vehicle type (gasoline vs electric vehicle). Figure 3 below

shows the equations used for estimating insurance premiums:

Additional Fees

Many states levy an annual fee on EVs, partially to compensate for lost gasoline tax revenue. We include

summarized state-specific EV fees in this analysis from the American Council for an Energy Efficient

Economy.

Total Monthly Ownership Costs

Total monthly ownership cost sums annual financing costs, operating costs, insurance costs, and additional

fees by vehicle and divides by 12 months.

RESULTS

Monthly ownership costs, including several sensitivities, as well as TCO, are discussed below.

Monthly Ownership Costs During Financing Term

Figure 2: Formula for Calculating Annual Operating Costs

Figure 3: Formulas for Calculating Insurance Costs

Figure 4: Formula for Calculating Total Monthly Ownership Costs

4

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

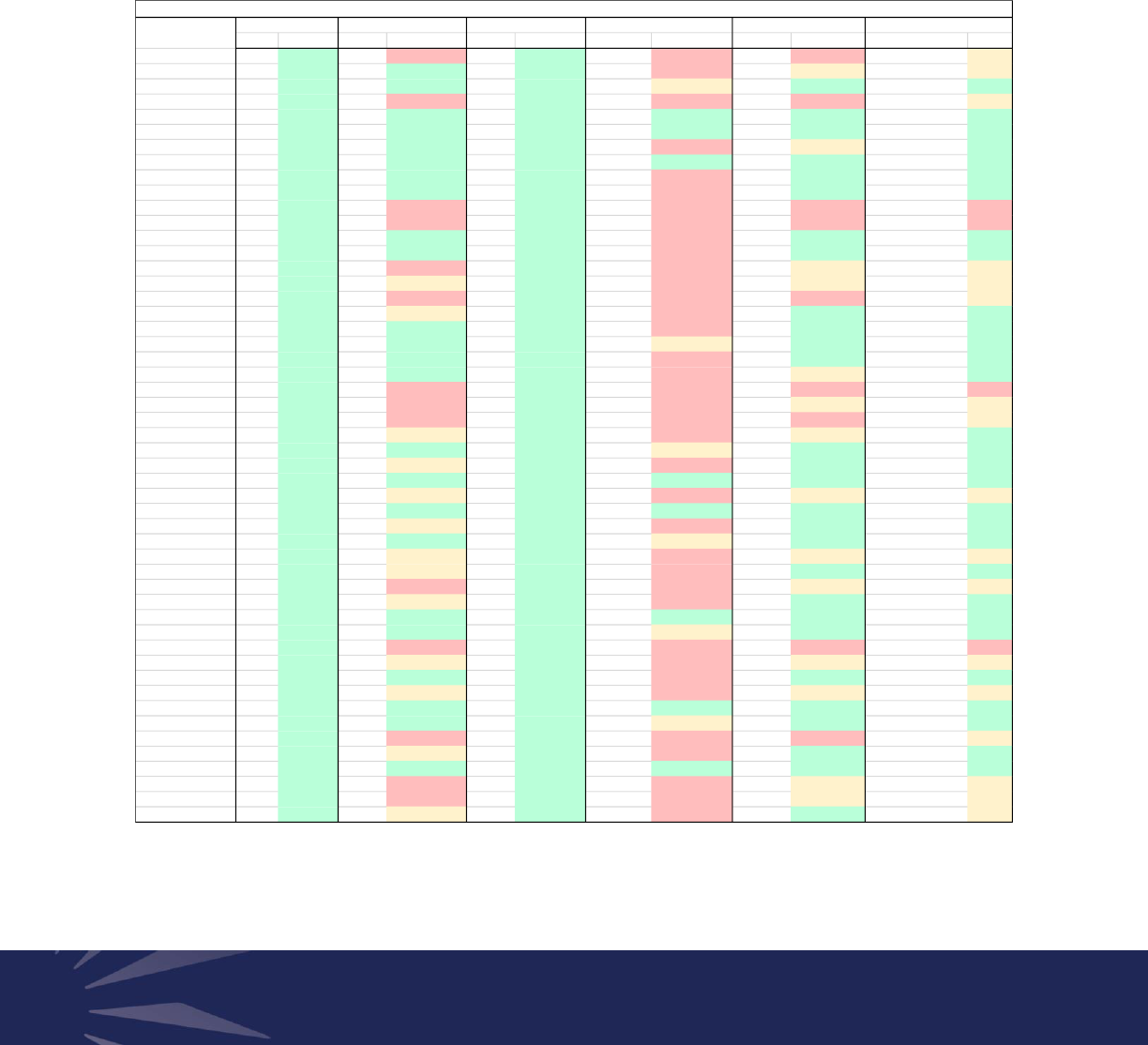

Estimated monthly ownership costs by state and vehicle model are shown in Table 3 with gasoline models

on the left of each vehicle comparison.

Vehicle and state combinations where the EV model is cheaper on a monthly basis are shaded in green. EV

models of the Hyundai Kona SEL and Ford F-150 are cheaper in every single state to finance and own today

than the equivalent gasoline model. The Volvo XC40 and Nissan models are just slightly more expensive,

on the order of a few dollars or less, in several of the states where it is cheaper to own the gasoline version.

For example, the Nissan Leaf’s monthly difference is less than $15 in Alaska, Arkansas, Indiana, Iowa,

Kansas, Minnesota, Mississippi, New Hampshire, Ohio, South Carolina, Tennessee, Vermont, West Virginia,

Wisconsin, and Wyoming, and less than $1 per month in some states. Yellow shaded cells below show

combinations where EVs were $15 or less per month more expensive to own. EVs that were than $15 a

month more to own are shaded red.

Table 3: Monthly Ownership Costs by Vehicle

SEL Electric SEL Limited Electric Limited XL Lightning Pro EX Premium EV EX Premium Inscription Recharge Plus Versa S Xtronic CVT LEAF

Alabama $724 $686 $804 $826 $905 $819 $816 $860 $1,027 $1,044 $568 $582

Alaska $736 $678 $813 $813 $927 $831 $813 $847 $1,035 $1,036 $575 $581

Arizona $755 $676 $836 $819 $950 $810 $841 $853 $1,068 $1,040 $588 $570

Arkansas $731 $694 $814 $838 $914 $825 $828 $872 $1,041 $1,059 $573 $587

California $802 $690 $885 $834 $1,021 $851 $876 $871 $1,129 $1,072 $620 $585

Colorado $725 $633 $804 $772 $907 $765 $814 $805 $1,026 $988 $568 $530

Connecticut $743 $680 $825 $823 $932 $838 $835 $860 $1,055 $1,058 $581 $576

Delaware $721 $610 $798 $745 $905 $738 $804 $777 $1,017 $955 $565 $511

District of Columbia $754 $680 $836 $824 $949 $816 $842 $858 $1,068 $1,046 $588 $574

Florida $742 $677 $824 $820 $930 $809 $834 $854 $1,053 $1,041 $580 $570

Georgia $719 $685 $799 $826 $897 $817 $813 $859 $1,021 $1,043 $565 $581

Hawaii $772 $740 $853 $880 $979 $924 $848 $918 $1,087 $1,126 $600 $641

Idaho $752 $682 $834 $825 $945 $810 $840 $859 $1,065 $1,044 $587 $575

Illinois $755 $690 $837 $834 $950 $826 $843 $868 $1,069 $1,057 $589 $584

Indiana $744 $700 $827 $844 $933 $837 $838 $879 $1,057 $1,069 $582 $593

Iowa $733 $685 $815 $828 $917 $819 $828 $862 $1,042 $1,049 $574 $578

Kansas $731 $691 $814 $835 $914 $826 $828 $869 $1,041 $1,058 $573 $584

Kentucky $731 $675 $813 $818 $914 $806 $827 $852 $1,040 $1,038 $573 $569

Louisiana $726 $665 $807 $806 $907 $793 $819 $839 $1,030 $1,022 $569 $560

Maine $743 $663 $824 $805 $932 $807 $833 $840 $1,053 $1,032 $581 $558

Maryland $745 $680 $827 $824 $935 $816 $836 $858 $1,057 $1,046 $582 $574

Massachusetts $745 $679 $827 $823 $935 $840 $837 $859 $1,057 $1,059 $582 $576

Michigan $745 $703 $828 $846 $936 $850 $836 $881 $1,057 $1,075 $583 $598

Minnesota $736 $692 $819 $837 $921 $830 $832 $871 $1,047 $1,061 $577 $586

Mississippi $733 $694 $816 $838 $917 $827 $831 $872 $1,044 $1,061 $575 $586

Missouri $722 $671 $803 $812 $902 $801 $816 $845 $1,026 $1,029 $567 $567

Montana $719 $641 $796 $776 $901 $765 $802 $807 $1,013 $984 $563 $541

Nebraska $732 $676 $814 $819 $916 $806 $826 $852 $1,040 $1,037 $574 $570

Nevada $777 $680 $860 $824 $984 $812 $859 $858 $1,098 $1,046 $604 $572

New Hampshire $718 $669 $795 $804 $900 $815 $802 $838 $1,013 $1,024 $563 $571

New Jersey $748 $588 $831 $723 $939 $726 $839 $756 $1,061 $938 $584 $489

New Mexico $736 $677 $818 $819 $923 $813 $828 $853 $1,044 $1,040 $576 $572

New York $741 $662 $822 $803 $931 $812 $828 $838 $1,048 $1,030 $579 $560

North Carolina $729 $679 $810 $820 $912 $809 $822 $854 $1,035 $1,038 $572 $574

North Dakota $731 $677 $812 $819 $914 $806 $824 $852 $1,037 $1,036 $573 $572

Ohio $735 $695 $817 $837 $920 $829 $829 $871 $1,044 $1,059 $576 $589

Oklahoma $724 $669 $805 $810 $905 $801 $818 $844 $1,029 $1,028 $568 $565

Oregon $737 $629 $814 $764 $929 $754 $814 $796 $1,036 $972 $575 $529

Pennsylvania $750 $672 $832 $815 $942 $809 $839 $850 $1,062 $1,038 $585 $566

Rhode Island $747 $716 $830 $861 $937 $876 $840 $897 $1,061 $1,097 $584 $612

South Carolina $732 $686 $814 $829 $915 $821 $827 $863 $1,040 $1,051 $574 $580

South Dakota $731 $669 $812 $810 $915 $801 $822 $844 $1,037 $1,028 $573 $564

Tennessee $738 $688 $821 $832 $924 $819 $834 $866 $1,050 $1,054 $578 $580

Texas $732 $644 $815 $787 $916 $777 $828 $821 $1,042 $1,008 $574 $537

Utah $749 $673 $830 $814 $943 $800 $835 $847 $1,060 $1,031 $585 $567

Vermont $746 $701 $828 $844 $936 $852 $836 $879 $1,058 $1,074 $583 $596

Virginia $732 $673 $812 $814 $917 $804 $822 $847 $1,037 $1,031 $573 $569

Washington $763 $649 $846 $784 $963 $771 $849 $816 $1,080 $991 $594 $549

West Virginia $738 $694 $820 $837 $925 $827 $831 $871 $1,048 $1,058 $578 $588

Wisconsin $731 $688 $813 $830 $915 $826 $824 $864 $1,038 $1,052 $573 $583

Wyoming $734 $680 $814 $820 $920 $808 $823 $853 $1,039 $1,036 $574 $575

Monthly Ownership Cost during Financing Term

2022 Volvo XC40

2022 Nissan

States

2022 Hyundai Kona

2022 Hyundai Kona

2022 Ford F-150

2022 Kia Niro

5

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

Kia Niro financing and operating costs are cheaper for the gasoline version in most states because of its

high fuel efficiency: The Kia Niro gasoline hybrid car gets 49 MPG, lowering the estimated fuel savings

between gasoline and EV versions.

The same subset of states, with higher electricity prices and/or lower gasoline prices, tend to be the ones

where gasoline vehicles remain more economic including Alaska, Georgia, Hawaii, Michigan, New

Hampshire, Rhode Island, and Vermont.

Figure 5 shows the average monthly cost of ownership during the finance term by vehicle across the U.S.

Figure 5: National Average Monthly Cost of Ownership during Finance Term

The Importance of Federal Tax Credits

The federal government offers a $7,500 tax credit for EVs sold by qualifying manufacturers that have sold

fewer than 200,000 EVs. Tesla and General Motors already passed this threshold, and their vehicles are no

longer eligible for the tax credit. Toyota, Ford, and Nissan are all likely to pass this threshold in 2022 or early

2023.

24

For example, Toyota recently announced it will pass the threshold this year and the tax credit will

soon be phased out for its vehicles.

25

Federal tax credits are critical to maintaining competitive EV financing

and ownership costs during the financing term. Without them, purchasing an EV becomes significantly

more expensive on a monthly basis.

Gas

Gas

Gas

Gas

Gas

Gas

EV

EV

EV

EV

EV

EV

$0

$200

$400

$600

$800

$1,000

$1,200

Hyundai Kona

SEL

Hyunda Kona

Limited

Ford F-150 Kia Niro EX Volvo XC40 Nissan Versa -

LEAF

Monthly Ownership Costs ($)

National Average Monthly Cost of Ownership during Finance Term

6

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

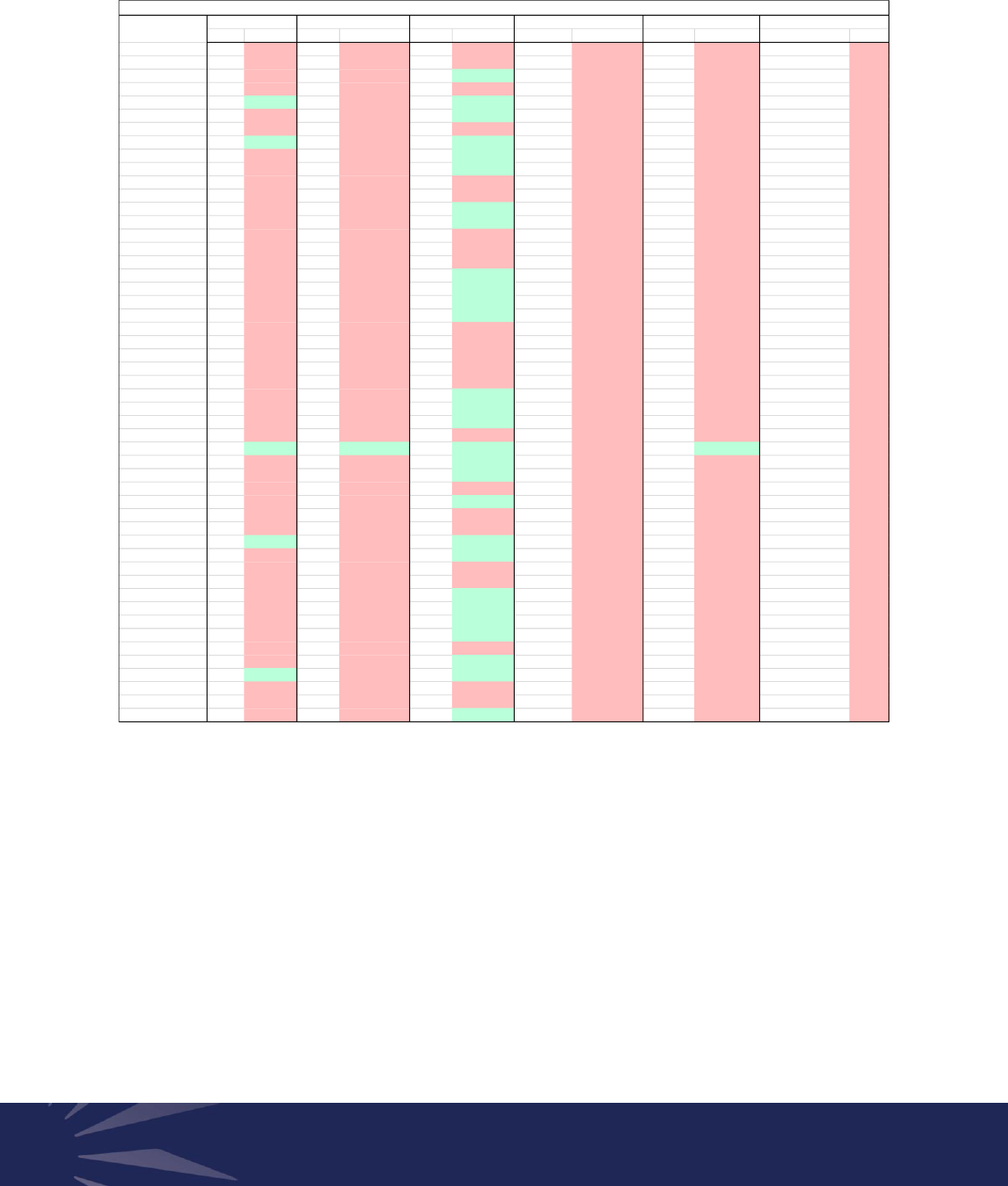

Table 4 shows monthly cost comparisons without any federal tax credits, making EVs considerably more

expensive on a monthly basis than gasoline counterparts.

SEL Electric SEL Limited Electric Limited XL Lightning Pro EX Premium EV EX Premium Inscription Recharge Plus Versa S Xtronic CVT LEAF

Alabama $724 $790 $804 $930 $905 $923 $816 $964 $1,027 $1,149 $568 $686

Alaska $736 $782 $813 $917 $927 $935 $813 $952 $1,035 $1,140 $575 $685

Arizona $755 $780 $836 $923 $950 $914 $841 $957 $1,068 $1,144 $588 $675

Arkansas $731 $798 $814 $942 $914 $929 $828 $976 $1,041 $1,163 $573 $691

California $802 $794 $885 $939 $1,021 $955 $876 $975 $1,129 $1,177 $620 $689

Colorado $725 $737 $804 $876 $907 $869 $814 $909 $1,026 $1,092 $568 $634

Connecticut $743 $784 $825 $928 $932 $942 $835 $964 $1,055 $1,162 $581 $680

Delaware $721 $715 $798 $850 $905 $842 $804 $881 $1,017 $1,059 $565 $615

District of Columbia $754 $785 $836 $928 $949 $920 $842 $962 $1,068 $1,150 $588 $679

Florida $742 $781 $824 $924 $930 $913 $834 $958 $1,053 $1,145 $580 $675

Georgia $719 $789 $799 $930 $897 $921 $813 $963 $1,021 $1,147 $565 $685

Hawaii $772 $844 $853 $985 $979 $1,028 $848 $1,023 $1,087 $1,230 $600 $746

Idaho $752 $787 $834 $930 $945 $914 $840 $963 $1,065 $1,148 $587 $680

Illinois $755 $795 $837 $938 $950 $931 $843 $972 $1,069 $1,161 $589 $688

Indiana $744 $804 $827 $948 $933 $941 $838 $983 $1,057 $1,173 $582 $697

Iowa $733 $789 $815 $932 $917 $923 $828 $966 $1,042 $1,154 $574 $683

Kansas $731 $795 $814 $939 $914 $930 $828 $973 $1,041 $1,162 $573 $688

Kentucky $731 $779 $813 $922 $914 $911 $827 $956 $1,040 $1,142 $573 $673

Louisiana $726 $769 $807 $910 $907 $898 $819 $943 $1,030 $1,126 $569 $664

Maine $743 $767 $824 $909 $932 $912 $833 $944 $1,053 $1,136 $581 $662

Maryland $745 $785 $827 $928 $935 $920 $836 $962 $1,057 $1,150 $582 $679

Massachusetts $745 $783 $827 $927 $935 $944 $837 $963 $1,057 $1,163 $582 $680

Michigan $745 $807 $828 $951 $936 $954 $836 $986 $1,057 $1,179 $583 $703

Minnesota $736 $797 $819 $941 $921 $934 $832 $975 $1,047 $1,165 $577 $690

Mississippi $733 $798 $816 $943 $917 $931 $831 $977 $1,044 $1,165 $575 $691

Missouri $722 $776 $803 $916 $902 $905 $816 $949 $1,026 $1,133 $567 $671

Montana $719 $745 $796 $880 $901 $869 $802 $912 $1,013 $1,088 $563 $645

Nebraska $732 $781 $814 $923 $916 $910 $826 $956 $1,040 $1,141 $574 $674

Nevada $777 $784 $860 $928 $984 $916 $859 $962 $1,098 $1,150 $604 $677

New Hampshire $718 $773 $795 $908 $900 $920 $802 $942 $1,013 $1,128 $563 $676

New Jersey $748 $692 $831 $827 $939 $830 $839 $860 $1,061 $1,042 $584 $594

New Mexico $736 $781 $818 $923 $923 $917 $828 $957 $1,044 $1,144 $576 $676

New York $741 $766 $822 $907 $931 $916 $828 $942 $1,048 $1,134 $579 $664

North Carolina $729 $783 $810 $925 $912 $913 $822 $958 $1,035 $1,142 $572 $678

North Dakota $731 $781 $812 $923 $914 $910 $824 $956 $1,037 $1,140 $573 $676

Ohio $735 $799 $817 $941 $920 $933 $829 $975 $1,044 $1,163 $576 $693

Oklahoma $724 $773 $805 $914 $905 $905 $818 $948 $1,029 $1,133 $568 $669

Oregon $737 $734 $814 $869 $929 $858 $814 $900 $1,036 $1,076 $575 $633

Pennsylvania $750 $776 $832 $919 $942 $913 $839 $954 $1,062 $1,143 $585 $670

Rhode Island $747 $820 $830 $965 $937 $980 $840 $1,001 $1,061 $1,202 $584 $716

South Carolina $732 $790 $814 $933 $915 $925 $827 $967 $1,040 $1,155 $574 $684

South Dakota $731 $773 $812 $914 $915 $905 $822 $948 $1,037 $1,132 $573 $669

Tennessee $738 $792 $821 $936 $924 $923 $834 $970 $1,050 $1,158 $578 $684

Texas $732 $748 $815 $891 $916 $881 $828 $925 $1,042 $1,113 $574 $641

Utah $749 $777 $830 $919 $943 $905 $835 $952 $1,060 $1,135 $585 $671

Vermont $746 $805 $828 $948 $936 $956 $836 $983 $1,058 $1,179 $583 $700

Virginia $732 $777 $812 $918 $917 $908 $822 $951 $1,037 $1,136 $573 $673

Washington $763 $754 $846 $889 $963 $875 $849 $920 $1,080 $1,095 $594 $653

West Virginia $738 $798 $820 $941 $925 $931 $831 $975 $1,048 $1,162 $578 $692

Wisconsin $731 $792 $813 $934 $915 $930 $824 $968 $1,038 $1,156 $573 $687

Wyoming $734 $784 $814 $924 $920 $912 $823 $957 $1,039 $1,140 $574 $679

Monthly Ownership Cost during Financing Term without Federal Tax Credits

States

2022 Hyundai Kona

2022 Hyundai Kona

2022 Ford F-150

2022 Kia Niro

2022 Volvo XC40

2022 Nissan

7

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

Table 4: Monthly Ownership Costs by Vehicle without Federal Tax Credits

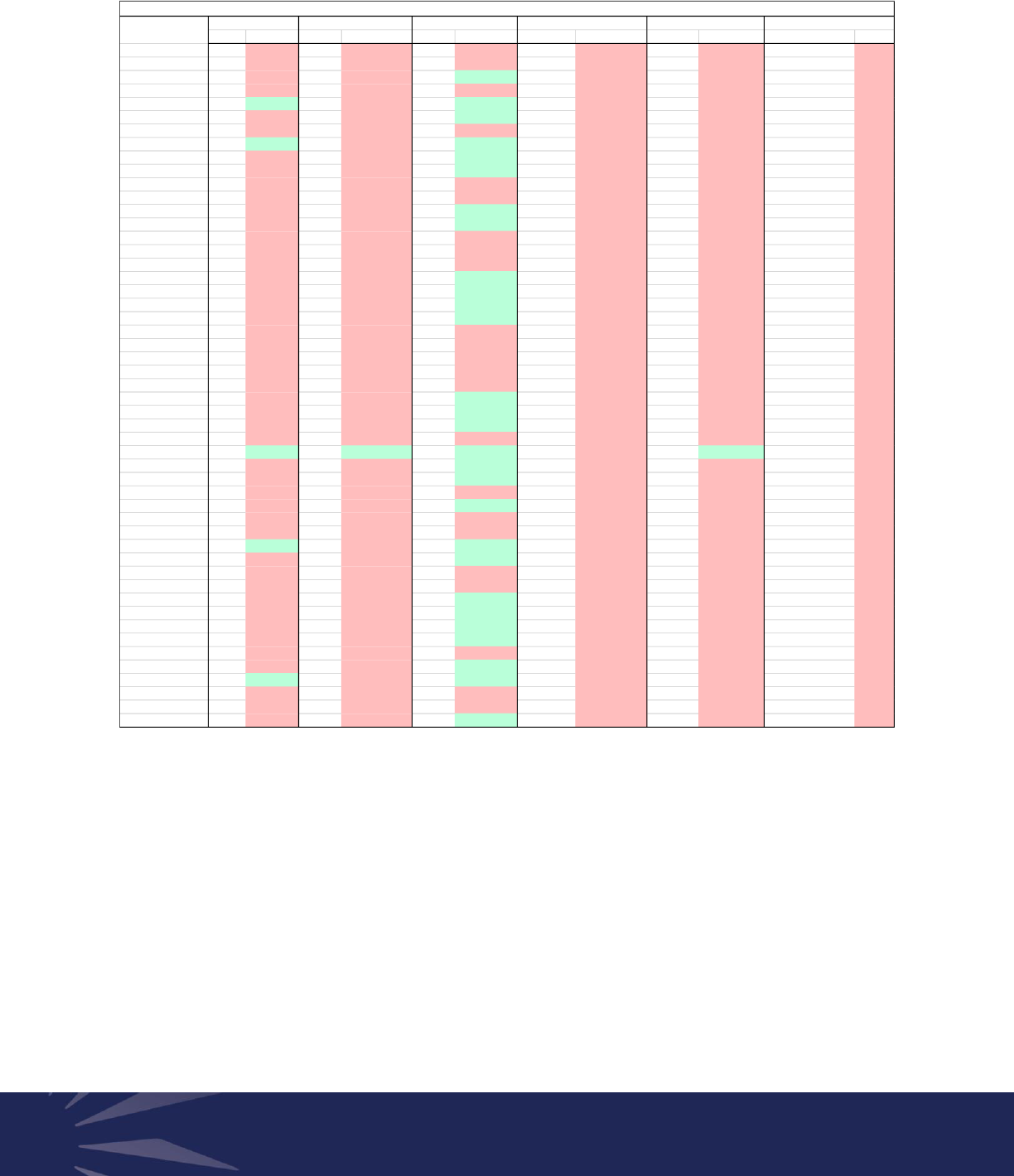

Extending and enhancing the EV tax credit could make even more EVs economic during a six-year loan term.

For example, Table 5 below shows how the economics would change with a $10,000 federal tax credit,

where only three states have any vehicles in the analysis that aren’t economic, confined to the Kia Niro

with a 50 MPG fuel efficiency gasoline version.

SEL Electric SEL Limited Electric Limited XL Lightning Pro EX Premium EV EX Premium Inscription Recharge Plus Versa S Xtronic CVT LEAF

Alabama $724 $790 $804 $930 $905 $923 $816 $964 $1,027 $1,149 $568 $686

Alaska $736 $782 $813 $917 $927 $935 $813 $952 $1,035 $1,140 $575 $685

Arizona $755 $780 $836 $923 $950 $914 $841 $957 $1,068 $1,144 $588 $675

Arkansas $731 $798 $814 $942 $914 $929 $828 $976 $1,041 $1,163 $573 $691

California $802 $794 $885 $939 $1,021 $955 $876 $975 $1,129 $1,177 $620 $689

Colorado $725 $737 $804 $876 $907 $869 $814 $909 $1,026 $1,092 $568 $634

Connecticut $743 $784 $825 $928 $932 $942 $835 $964 $1,055 $1,162 $581 $680

Delaware $721 $715 $798 $850 $905 $842 $804 $881 $1,017 $1,059 $565 $615

District of Columbia $754 $785 $836 $928 $949 $920 $842 $962 $1,068 $1,150 $588 $679

Florida $742 $781 $824 $924 $930 $913 $834 $958 $1,053 $1,145 $580 $675

Georgia $719 $789 $799 $930 $897 $921 $813 $963 $1,021 $1,147 $565 $685

Hawaii $772 $844 $853 $985 $979 $1,028 $848 $1,023 $1,087 $1,230 $600 $746

Idaho $752 $787 $834 $930 $945 $914 $840 $963 $1,065 $1,148 $587 $680

Illinois $755 $795 $837 $938 $950 $931 $843 $972 $1,069 $1,161 $589 $688

Indiana $744 $804 $827 $948 $933 $941 $838 $983 $1,057 $1,173 $582 $697

Iowa $733 $789 $815 $932 $917 $923 $828 $966 $1,042 $1,154 $574 $683

Kansas $731 $795 $814 $939 $914 $930 $828 $973 $1,041 $1,162 $573 $688

Kentucky $731 $779 $813 $922 $914 $911 $827 $956 $1,040 $1,142 $573 $673

Louisiana $726 $769 $807 $910 $907 $898 $819 $943 $1,030 $1,126 $569 $664

Maine $743 $767 $824 $909 $932 $912 $833 $944 $1,053 $1,136 $581 $662

Maryland $745 $785 $827 $928 $935 $920 $836 $962 $1,057 $1,150 $582 $679

Massachusetts $745 $783 $827 $927 $935 $944 $837 $963 $1,057 $1,163 $582 $680

Michigan $745 $807 $828 $951 $936 $954 $836 $986 $1,057 $1,179 $583 $703

Minnesota $736 $797 $819 $941 $921 $934 $832 $975 $1,047 $1,165 $577 $690

Mississippi $733 $798 $816 $943 $917 $931 $831 $977 $1,044 $1,165 $575 $691

Missouri $722 $776 $803 $916 $902 $905 $816 $949 $1,026 $1,133 $567 $671

Montana $719 $745 $796 $880 $901 $869 $802 $912 $1,013 $1,088 $563 $645

Nebraska $732 $781 $814 $923 $916 $910 $826 $956 $1,040 $1,141 $574 $674

Nevada $777 $784 $860 $928 $984 $916 $859 $962 $1,098 $1,150 $604 $677

New Hampshire $718 $773 $795 $908 $900 $920 $802 $942 $1,013 $1,128 $563 $676

New Jersey $748 $692 $831 $827 $939 $830 $839 $860 $1,061 $1,042 $584 $594

New Mexico $736 $781 $818 $923 $923 $917 $828 $957 $1,044 $1,144 $576 $676

New York $741 $766 $822 $907 $931 $916 $828 $942 $1,048 $1,134 $579 $664

North Carolina $729 $783 $810 $925 $912 $913 $822 $958 $1,035 $1,142 $572 $678

North Dakota $731 $781 $812 $923 $914 $910 $824 $956 $1,037 $1,140 $573 $676

Ohio $735 $799 $817 $941 $920 $933 $829 $975 $1,044 $1,163 $576 $693

Oklahoma $724 $773 $805 $914 $905 $905 $818 $948 $1,029 $1,133 $568 $669

Oregon $737 $734 $814 $869 $929 $858 $814 $900 $1,036 $1,076 $575 $633

Pennsylvania $750 $776 $832 $919 $942 $913 $839 $954 $1,062 $1,143 $585 $670

Rhode Island $747 $820 $830 $965 $937 $980 $840 $1,001 $1,061 $1,202 $584 $716

South Carolina $732 $790 $814 $933 $915 $925 $827 $967 $1,040 $1,155 $574 $684

South Dakota $731 $773 $812 $914 $915 $905 $822 $948 $1,037 $1,132 $573 $669

Tennessee $738 $792 $821 $936 $924 $923 $834 $970 $1,050 $1,158 $578 $684

Texas $732 $748 $815 $891 $916 $881 $828 $925 $1,042 $1,113 $574 $641

Utah $749 $777 $830 $919 $943 $905 $835 $952 $1,060 $1,135 $585 $671

Vermont $746 $805 $828 $948 $936 $956 $836 $983 $1,058 $1,179 $583 $700

Virginia $732 $777 $812 $918 $917 $908 $822 $951 $1,037 $1,136 $573 $673

Washington $763 $754 $846 $889 $963 $875 $849 $920 $1,080 $1,095 $594 $653

West Virginia $738 $798 $820 $941 $925 $931 $831 $975 $1,048 $1,162 $578 $692

Wisconsin $731 $792 $813 $934 $915 $930 $824 $968 $1,038 $1,156 $573 $687

Wyoming $734 $784 $814 $924 $920 $912 $823 $957 $1,039 $1,140 $574 $679

Monthly Ownership Cost during Financing Term without Federal Tax Credits

States

2022 Hyundai Kona

2022 Hyundai Kona

2022 Ford F-150

2022 Kia Niro

2022 Volvo XC40

2022 Nissan

8

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

Table 5: Monthly Ownership Costs by Vehicle with a $10,000 Federal Tax Credit

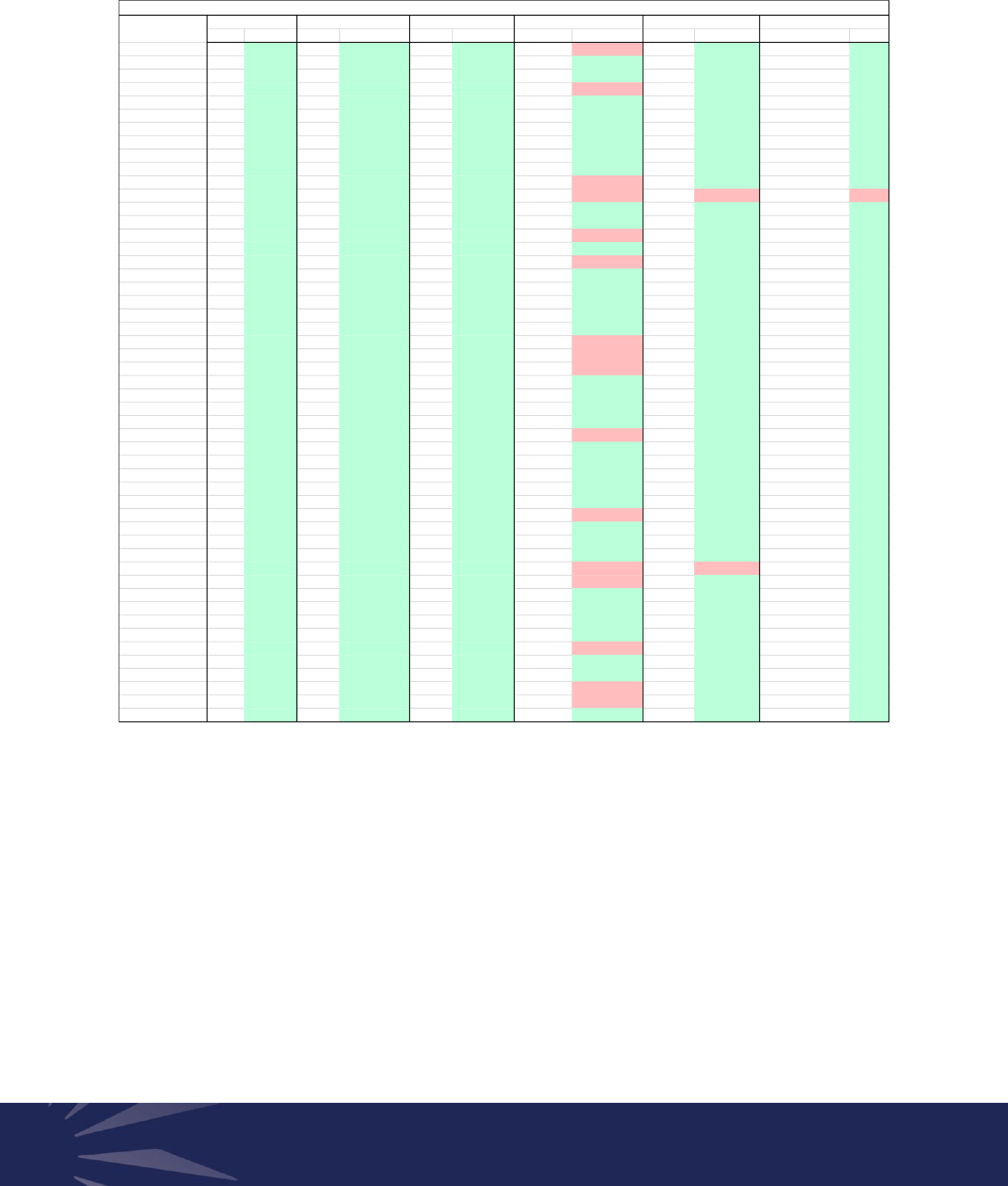

Annual Ownership Costs

Over the course of a year, savings can add up to thousands of dollars. The Hyundai Electric SEL is nearly

$800 less a year than the gasoline version, and the Ford F-150 Lightning Pro is nearly $1,400 less a year.

Though it varies by vehicle make, model, and state, consumers purchasing an EV instead of a gasoline model

frequently begin accruing substantial savings from their day the car is driven off the lot. Table 6 shows

annual ownership costs by vehicle and state.

SEL Electric SEL Limited Electric Limited XL Lightning Pro EX Premium EV EX Premium Inscription Recharge Plus Versa S Xtronic CVT LEAF

Alabama $724 $651 $804 $791 $905 $784 $816 $825 $1,027 $1,010 $568 $547

Alaska $736 $643 $813 $778 $927 $796 $813 $813 $1,035 $1,002 $575 $546

Arizona $755 $642 $836 $784 $950 $775 $841 $818 $1,068 $1,005 $588 $536

Arkansas $731 $659 $814 $803 $914 $791 $828 $837 $1,041 $1,024 $573 $552

California $802 $655 $885 $800 $1,021 $816 $876 $836 $1,129 $1,038 $620 $550

Colorado $725 $598 $804 $737 $907 $730 $814 $770 $1,026 $953 $568 $495

Connecticut $743 $645 $825 $789 $932 $803 $835 $825 $1,055 $1,024 $581 $541

Delaware $721 $576 $798 $711 $905 $703 $804 $743 $1,017 $920 $565 $476

District of Columbia $754 $646 $836 $789 $949 $781 $842 $823 $1,068 $1,011 $588 $540

Florida $742 $642 $824 $785 $930 $775 $834 $819 $1,053 $1,006 $580 $536

Georgia $719 $651 $799 $791 $897 $783 $813 $824 $1,021 $1,009 $565 $546

Hawaii $772 $705 $853 $846 $979 $889 $848 $884 $1,087 $1,091 $600 $607

Idaho $752 $648 $834 $791 $945 $776 $840 $824 $1,065 $1,009 $587 $541

Illinois $755 $656 $837 $799 $950 $792 $843 $833 $1,069 $1,022 $589 $549

Indiana $744 $665 $827 $809 $933 $802 $838 $844 $1,057 $1,034 $582 $558

Iowa $733 $650 $815 $793 $917 $784 $828 $827 $1,042 $1,015 $574 $544

Kansas $731 $656 $814 $800 $914 $792 $828 $834 $1,041 $1,023 $573 $549

Kentucky $731 $640 $813 $783 $914 $772 $827 $817 $1,040 $1,004 $573 $534

Louisiana $726 $630 $807 $771 $907 $759 $819 $804 $1,030 $988 $569 $525

Maine $743 $628 $824 $770 $932 $773 $833 $805 $1,053 $997 $581 $523

Maryland $745 $646 $827 $789 $935 $781 $836 $823 $1,057 $1,011 $582 $540

Massachusetts $745 $645 $827 $788 $935 $805 $837 $825 $1,057 $1,024 $582 $541

Michigan $745 $669 $828 $812 $936 $815 $836 $847 $1,057 $1,040 $583 $564

Minnesota $736 $658 $819 $802 $921 $795 $832 $837 $1,047 $1,027 $577 $551

Mississippi $733 $659 $816 $804 $917 $792 $831 $838 $1,044 $1,026 $575 $552

Missouri $722 $637 $803 $777 $902 $766 $816 $810 $1,026 $994 $567 $532

Montana $719 $606 $796 $741 $901 $731 $802 $773 $1,013 $949 $563 $506

Nebraska $732 $642 $814 $784 $916 $771 $826 $817 $1,040 $1,002 $574 $535

Nevada $777 $645 $860 $789 $984 $777 $859 $823 $1,098 $1,011 $604 $538

New Hampshire $718 $634 $795 $769 $900 $781 $802 $803 $1,013 $989 $563 $537

New Jersey $748 $553 $831 $689 $939 $691 $839 $721 $1,061 $903 $584 $455

New Mexico $736 $642 $818 $784 $923 $778 $828 $818 $1,044 $1,006 $576 $537

New York $741 $628 $822 $768 $931 $777 $828 $803 $1,048 $995 $579 $525

North Carolina $729 $644 $810 $786 $912 $774 $822 $819 $1,035 $1,003 $572 $539

North Dakota $731 $643 $812 $784 $914 $771 $824 $818 $1,037 $1,001 $573 $537

Ohio $735 $660 $817 $803 $920 $794 $829 $837 $1,044 $1,024 $576 $554

Oklahoma $724 $634 $805 $776 $905 $766 $818 $809 $1,029 $994 $568 $530

Oregon $737 $595 $814 $730 $929 $719 $814 $761 $1,036 $938 $575 $495

Pennsylvania $750 $637 $832 $781 $942 $775 $839 $815 $1,062 $1,004 $585 $532

Rhode Island $747 $681 $830 $826 $937 $841 $840 $863 $1,061 $1,063 $584 $577

South Carolina $732 $651 $814 $794 $915 $786 $827 $828 $1,040 $1,016 $574 $545

South Dakota $731 $634 $812 $776 $915 $766 $822 $809 $1,037 $994 $573 $530

Tennessee $738 $653 $821 $798 $924 $785 $834 $831 $1,050 $1,019 $578 $545

Texas $732 $609 $815 $752 $916 $742 $828 $786 $1,042 $974 $574 $502

Utah $749 $638 $830 $780 $943 $766 $835 $813 $1,060 $996 $585 $533

Vermont $746 $666 $828 $809 $936 $817 $836 $845 $1,058 $1,040 $583 $561

Virginia $732 $638 $812 $779 $917 $769 $822 $812 $1,037 $997 $573 $534

Washington $763 $615 $846 $750 $963 $736 $849 $781 $1,080 $956 $594 $514

West Virginia $738 $659 $820 $802 $925 $792 $831 $836 $1,048 $1,023 $578 $553

Wisconsin $731 $653 $813 $795 $915 $791 $824 $829 $1,038 $1,017 $573 $549

Wyoming $734 $645 $814 $785 $920 $773 $823 $818 $1,039 $1,001 $574 $540

2022 Hyundai Kona

2022 Ford F-150

2022 Kia Niro

2022 Volvo XC40

2022 Nissan

Monthly Ownership Cost during Financing Term with $10,000 Federal Tax Credit

States

2022 Hyundai Kona

9

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

Table 6: Annual Ownership Costs by Vehicle

Total Cost of Ownership

The analysis above focuses on monthly costs during the financing term, which includes monthly loan

repayment. However, after a vehicle loan is paid off, monthly savings for EVs grow dramatically. For

example, Table 7 below shows monthly ownership costs after loan repayment. At this point, consumers

save on average anywhere from $1,500 to $2,000 per year, with some vehicle-state combinations as high

as $3,000 per year.

SEL Electric SEL Limited Electric Limited XL Lightning Pro EX Premium EV EX Premium Inscription Recharge Plus Versa S Xtronic CVT LEAF

Alabama $8,683 $8,229 $9,650 $9,914 $10,855 $9,828 $9,795 $10,315 $12,322 $12,533 $6,813 $6,982

Alaska $8,830 $8,137 $9,759 $9,758 $11,125 $9,975 $9,759 $10,169 $12,416 $12,435 $6,896 $6,972

Arizona $9,054 $8,115 $10,037 $9,826 $11,402 $9,718 $10,091 $10,232 $12,814 $12,475 $7,061 $6,846

Arkansas $8,774 $8,327 $9,766 $10,052 $10,966 $9,903 $9,938 $10,458 $12,489 $12,702 $6,881 $7,042

California $9,624 $8,275 $10,623 $10,012 $12,252 $10,209 $10,518 $10,454 $13,551 $12,868 $7,438 $7,017

Colorado $8,696 $7,591 $9,652 $9,258 $10,887 $9,178 $9,768 $9,655 $12,314 $11,851 $6,818 $6,358

Connecticut $8,913 $8,159 $9,903 $9,882 $11,179 $10,052 $10,024 $10,317 $12,657 $12,700 $6,971 $6,909

Delaware $8,653 $7,324 $9,581 $8,945 $10,855 $8,859 $9,644 $9,328 $12,198 $11,459 $6,780 $6,127

District of Columbia $9,048 $8,165 $10,034 $9,882 $11,388 $9,790 $10,100 $10,291 $12,815 $12,550 $7,058 $6,892

Florida $8,901 $8,121 $9,888 $9,838 $11,165 $9,712 $10,004 $10,244 $12,635 $12,487 $6,962 $6,844

Georgia $8,626 $8,223 $9,593 $9,908 $10,769 $9,808 $9,759 $10,308 $12,252 $12,519 $6,776 $6,974

Hawaii $9,268 $8,879 $10,236 $10,564 $11,747 $11,089 $10,178 $11,022 $13,043 $13,512 $7,195 $7,697

Idaho $9,019 $8,188 $10,006 $9,906 $11,344 $9,724 $10,081 $10,306 $12,780 $12,525 $7,039 $6,906

Illinois $9,057 $8,286 $10,046 $10,008 $11,400 $9,917 $10,115 $10,418 $12,832 $12,683 $7,065 $7,010

Indiana $8,926 $8,395 $9,922 $10,129 $11,191 $10,042 $10,054 $10,542 $12,687 $12,825 $6,981 $7,110

Iowa $8,792 $8,215 $9,779 $9,932 $10,999 $9,828 $9,933 $10,340 $12,500 $12,594 $6,891 $6,941

Kansas $8,776 $8,290 $9,768 $10,016 $10,968 $9,915 $9,939 $10,426 $12,491 $12,692 $6,882 $7,011

Kentucky $8,774 $8,101 $9,761 $9,818 $10,971 $9,677 $9,921 $10,223 $12,478 $12,459 $6,879 $6,823

Louisiana $8,707 $7,978 $9,679 $9,671 $10,887 $9,521 $9,826 $10,068 $12,362 $12,267 $6,830 $6,719

Maine $8,911 $7,952 $9,893 $9,662 $11,185 $9,689 $9,994 $10,080 $12,636 $12,381 $6,967 $6,699

Maryland $8,940 $8,165 $9,927 $9,883 $11,224 $9,790 $10,030 $10,292 $12,682 $12,550 $6,987 $6,893

Massachusetts $8,941 $8,152 $9,930 $9,873 $11,222 $10,076 $10,038 $10,311 $12,689 $12,706 $6,989 $6,907

Michigan $8,944 $8,439 $9,931 $10,157 $11,230 $10,197 $10,032 $10,578 $12,687 $12,895 $6,990 $7,180

Minnesota $8,831 $8,310 $9,826 $10,042 $11,047 $9,954 $9,987 $10,455 $12,567 $12,735 $6,919 $7,027

Mississippi $8,800 $8,326 $9,796 $10,060 $10,998 $9,921 $9,971 $10,469 $12,531 $12,729 $6,899 $7,036

Missouri $8,667 $8,056 $9,637 $9,745 $10,828 $9,610 $9,793 $10,142 $12,308 $12,343 $6,803 $6,801

Montana $8,622 $7,689 $9,551 $9,310 $10,808 $9,184 $9,623 $9,689 $12,160 $11,802 $6,760 $6,488

Nebraska $8,781 $8,116 $9,763 $9,826 $10,988 $9,666 $9,910 $10,226 $12,476 $12,444 $6,882 $6,843

Nevada $9,328 $8,157 $10,323 $9,889 $11,806 $9,743 $10,311 $10,296 $13,179 $12,550 $7,244 $6,868

New Hampshire $8,617 $8,029 $9,546 $9,650 $10,800 $9,785 $9,620 $10,054 $12,154 $12,283 $6,757 $6,856

New Jersey $8,973 $7,058 $9,966 $8,679 $11,268 $8,708 $10,072 $9,073 $12,737 $11,255 $7,011 $5,873

New Mexico $8,833 $8,126 $9,812 $9,829 $11,072 $9,755 $9,931 $10,236 $12,532 $12,483 $6,915 $6,866

New York $8,891 $7,947 $9,859 $9,633 $11,173 $9,739 $9,932 $10,051 $12,579 $12,355 $6,949 $6,721

North Carolina $8,750 $8,147 $9,724 $9,844 $10,948 $9,707 $9,864 $10,243 $12,421 $12,455 $6,859 $6,885

North Dakota $8,768 $8,127 $9,745 $9,828 $10,973 $9,670 $9,884 $10,227 $12,449 $12,434 $6,872 $6,860

Ohio $8,821 $8,334 $9,805 $10,048 $11,046 $9,946 $9,944 $10,455 $12,531 $12,703 $6,909 $7,064

Oklahoma $8,690 $8,030 $9,663 $9,724 $10,861 $9,611 $9,817 $10,124 $12,343 $12,341 $6,820 $6,774

Oregon $8,845 $7,552 $9,773 $9,173 $11,147 $9,049 $9,769 $9,553 $12,434 $11,667 $6,906 $6,351

Pennsylvania $8,994 $8,066 $9,981 $9,784 $11,306 $9,711 $10,065 $10,194 $12,749 $12,462 $7,023 $6,795

Rhode Island $8,965 $8,594 $9,961 $10,328 $11,250 $10,509 $10,079 $10,767 $12,734 $13,169 $7,007 $7,338

South Carolina $8,780 $8,227 $9,767 $9,944 $10,980 $9,853 $9,925 $10,353 $12,485 $12,613 $6,883 $6,954

South Dakota $8,770 $8,030 $9,743 $9,723 $10,983 $9,610 $9,869 $10,123 $12,441 $12,340 $6,872 $6,774

Tennessee $8,855 $8,253 $9,851 $9,987 $11,082 $9,831 $10,007 $10,395 $12,599 $12,646 $6,935 $6,961

Texas $8,789 $7,723 $9,778 $9,444 $10,991 $9,318 $9,939 $9,851 $12,502 $12,100 $6,889 $6,443

Utah $8,988 $8,074 $9,964 $9,773 $11,311 $9,605 $10,023 $10,170 $12,717 $12,370 $7,015 $6,808

Vermont $8,947 $8,408 $9,933 $10,125 $11,234 $10,218 $10,034 $10,552 $12,690 $12,893 $6,992 $7,155

Virginia $8,779 $8,076 $9,749 $9,766 $10,998 $9,650 $9,868 $10,165 $12,447 $12,376 $6,877 $6,822

Washington $9,161 $7,793 $10,153 $9,414 $11,555 $9,253 $10,191 $9,790 $12,965 $11,887 $7,133 $6,588

West Virginia $8,855 $8,326 $9,842 $10,044 $11,095 $9,922 $9,974 $10,450 $12,578 $12,696 $6,932 $7,051

Wisconsin $8,773 $8,254 $9,750 $9,956 $10,981 $9,910 $9,888 $10,364 $12,455 $12,622 $6,875 $6,999

Wyoming $8,803 $8,155 $9,771 $9,840 $11,039 $9,697 $9,874 $10,235 $12,471 $12,428 $6,892 $6,902

2022 Volvo XC40

2022 Nissan

Annual Ownership Cost during Financing Term

States

2022 Hyundai Kona

2022 Hyundai Kona

2022 Ford F-150

2022 Kia Niro

10

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

Table 7: Monthly Ownership Cost by Vehicle after Loan Repayment

Because EVs are so much more efficient with significantly lower maintenance costs, vehicle TCO over

average lifetimes are significantly lower today for EVs than for gasoline vehicles. Table 8 below shows TCO

during the vehicle lifetime, estimated at 12 years based on national data,

26

and Figure 6 compares average

national TCO across each pair of vehicle comparisons.

Even though EVs are often cheaper to own on a monthly basis even during loan repayment and much lower

on a TCO basis higher purchase costs can dissuade potential EV owners from purchasing. Better

understanding around the costs of EV ownership is needed to overcome this information barrier.

SEL Electric SEL Limited Electric Limited XL Lightning Pro EX Premium EV EX Premium Inscription Recharge Plus Versa S Xtronic CVT LEAF

Alabama $363 $257 $370 $267 $443 $298 $327 $273 $416 $300 $307 $252

Alaska $391 $272 $398 $282 $486 $336 $345 $290 $451 $328 $326 $269

Arizona $388 $238 $394 $249 $481 $278 $343 $254 $447 $281 $324 $234

Arkansas $361 $251 $368 $261 $440 $287 $326 $267 $414 $292 $306 $246

California $429 $281 $435 $291 $543 $346 $370 $299 $497 $337 $350 $279

Colorado $369 $245 $375 $255 $451 $285 $331 $260 $423 $288 $311 $240

Connecticut $373 $269 $380 $279 $458 $332 $334 $287 $428 $324 $314 $267

Delaware $376 $238 $383 $249 $463 $278 $336 $254 $432 $281 $316 $234

District of Columbia $386 $240 $392 $251 $478 $281 $342 $256 $444 $284 $322 $236

Florida $374 $237 $380 $247 $459 $275 $334 $252 $429 $278 $314 $232

Georgia $359 $256 $365 $267 $436 $296 $324 $272 $410 $299 $304 $252

Hawaii $412 $311 $418 $321 $518 $403 $359 $332 $476 $382 $339 $312

Idaho $383 $242 $390 $253 $474 $276 $340 $257 $441 $282 $321 $237

Illinois $386 $249 $392 $259 $477 $290 $342 $265 $444 $293 $322 $244

Indiana $372 $254 $378 $264 $456 $296 $333 $270 $427 $298 $313 $249

Iowa $365 $245 $371 $255 $445 $284 $328 $260 $418 $287 $308 $240

Kansas $361 $248 $368 $258 $440 $288 $326 $264 $414 $291 $306 $243

Kentucky $363 $235 $369 $245 $443 $272 $327 $251 $416 $276 $307 $230

Louisiana $364 $233 $370 $244 $444 $269 $327 $249 $417 $274 $308 $228

Maine $376 $253 $383 $263 $463 $304 $336 $270 $432 $302 $316 $250

Maryland $377 $240 $383 $251 $464 $281 $336 $256 $433 $284 $316 $236

Massachusetts $376 $273 $382 $283 $463 $338 $335 $291 $432 $329 $316 $271

Michigan $377 $263 $384 $273 $465 $315 $336 $280 $433 $312 $317 $260

Minnesota $364 $248 $371 $258 $445 $289 $328 $264 $418 $291 $308 $243

Mississippi $361 $248 $368 $258 $440 $286 $326 $264 $414 $290 $306 $243

Missouri $361 $241 $367 $251 $440 $278 $326 $257 $413 $282 $306 $236

Montana $374 $234 $380 $244 $459 $270 $334 $250 $429 $275 $314 $229

Nebraska $366 $239 $372 $249 $447 $274 $329 $254 $419 $279 $309 $234

Nevada $406 $235 $412 $245 $508 $272 $355 $250 $469 $276 $335 $230

New Hampshire $374 $263 $380 $273 $459 $320 $334 $280 $429 $315 $314 $260

New Jersey $377 $251 $384 $261 $465 $300 $336 $268 $433 $299 $317 $247

New Mexico $371 $242 $378 $252 $456 $284 $332 $258 $426 $286 $313 $237

New York $381 $261 $387 $271 $470 $318 $338 $279 $438 $313 $319 $258

North Carolina $366 $246 $372 $256 $447 $283 $329 $261 $419 $287 $309 $241

North Dakota $366 $243 $373 $253 $448 $278 $329 $258 $420 $283 $310 $237

Ohio $368 $256 $374 $266 $450 $296 $330 $272 $422 $299 $311 $251

Oklahoma $362 $238 $368 $248 $441 $276 $326 $253 $415 $280 $307 $233

Oregon $392 $244 $399 $254 $488 $280 $346 $259 $452 $284 $327 $238

Pennsylvania $381 $243 $388 $253 $471 $285 $339 $259 $438 $287 $319 $238

Rhode Island $375 $271 $381 $281 $461 $335 $335 $289 $431 $326 $315 $268

South Carolina $364 $246 $370 $256 $444 $286 $327 $261 $417 $289 $308 $241

South Dakota $369 $237 $375 $248 $451 $276 $331 $253 $423 $280 $311 $233

Tennessee $366 $242 $372 $252 $447 $278 $329 $258 $419 $283 $309 $237

Texas $363 $237 $370 $247 $443 $275 $327 $252 $416 $279 $308 $232

Utah $385 $239 $392 $249 $477 $273 $342 $254 $443 $279 $322 $234

Vermont $377 $261 $384 $271 $465 $317 $336 $278 $434 $312 $317 $258

Virginia $370 $242 $377 $253 $454 $281 $332 $258 $425 $284 $312 $237

Washington $393 $243 $400 $253 $489 $276 $347 $258 $453 $282 $327 $237

West Virginia $370 $254 $376 $264 $453 $292 $331 $269 $424 $296 $312 $249

Wisconsin $367 $253 $373 $264 $449 $298 $329 $270 $421 $299 $310 $249

Wyoming $373 $251 $380 $261 $459 $287 $334 $266 $429 $291 $314 $245

Monthly Ownership Cost after Financing Term

States

2022 Hyundai Kona

2022 Hyundai Kona

2022 Ford F-150

2022 Kia Niro

2022 Volvo XC40

2022 Nissan

11

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

Table 8: Total Cost of Ownership during Vehicle Lifetime

SEL Electric SEL Limited Electric Limited XL Lightning Pro EX Premium EV EX Premium Inscription Recharge Plus Versa S Xtronic CVT LEAF

Alabama $60,729 $54,522 $66,497 $64,095 $75,368 $64,898 $66,247 $66,777 $83,174 $80,035 $48,461 $47,173

Alaska $62,443 $54,350 $68,016 $63,597 $78,212 $66,760 $66,699 $66,411 $84,845 $80,281 $49,515 $47,503

Arizona $63,459 $53,091 $69,306 $62,794 $79,437 $63,438 $68,297 $65,497 $86,711 $78,859 $50,270 $45,623

Arkansas $61,117 $54,813 $67,007 $64,589 $75,816 $64,920 $66,918 $67,283 $83,927 $80,605 $48,755 $47,255

California $67,758 $55,138 $73,685 $64,976 $85,892 $68,060 $71,380 $67,943 $92,183 $82,572 $53,105 $47,825

Colorado $60,982 $50,409 $66,697 $59,893 $75,819 $60,730 $66,229 $62,554 $83,366 $75,706 $48,609 $43,133

Connecticut $62,237 $54,102 $68,120 $63,867 $77,532 $66,731 $67,624 $66,793 $85,289 $81,226 $49,485 $46,823

Delaware $61,037 $48,801 $66,610 $58,048 $76,069 $58,806 $65,781 $60,638 $83,114 $73,437 $48,597 $41,699

District of Columbia $63,353 $53,408 $69,219 $63,143 $79,253 $63,919 $68,295 $65,867 $86,625 $79,332 $50,208 $45,929

Florida $62,191 $53,056 $68,057 $62,792 $77,482 $63,298 $67,536 $65,491 $85,194 $78,836 $49,449 $45,549

Georgia $60,281 $54,489 $66,049 $64,062 $74,686 $64,750 $65,954 $66,733 $82,624 $79,940 $48,168 $47,127

Hawaii $65,378 $59,515 $71,147 $69,088 $82,453 $74,745 $69,283 $72,224 $88,897 $87,641 $51,497 $52,680

Idaho $63,126 $53,745 $68,992 $63,481 $78,907 $63,548 $68,146 $66,139 $86,345 $79,288 $50,059 $46,191

Illinois $63,396 $54,429 $69,274 $64,185 $79,303 $64,982 $68,364 $66,916 $86,705 $80,418 $50,240 $46,937

Indiana $62,251 $55,202 $68,166 $65,019 $77,515 $65,854 $67,742 $67,771 $85,378 $81,372 $49,504 $47,666

Iowa $61,326 $53,875 $67,192 $63,611 $76,163 $64,295 $66,971 $66,326 $84,129 $79,750 $48,884 $46,386

Kansas $61,130 $54,416 $67,021 $64,192 $75,836 $64,910 $66,926 $66,922 $83,944 $80,416 $48,764 $46,899

Kentucky $61,182 $52,899 $67,048 $62,635 $75,944 $63,021 $66,877 $65,322 $83,953 $78,614 $48,790 $45,379

Louisiana $60,862 $52,229 $66,652 $61,838 $75,546 $62,143 $66,409 $64,484 $83,388 $77,569 $48,555 $44,798

Maine $62,336 $52,540 $68,178 $62,235 $77,732 $63,957 $67,547 $65,036 $85,318 $78,867 $49,535 $45,193

Maryland $62,498 $53,411 $68,364 $63,147 $77,950 $63,924 $67,736 $65,871 $85,572 $79,336 $49,649 $45,932

Massachusetts $62,471 $54,158 $68,349 $63,914 $77,893 $67,032 $67,760 $66,862 $85,566 $81,397 $49,635 $46,912

Michigan $62,532 $55,691 $68,398 $65,427 $78,001 $67,258 $67,758 $68,249 $85,614 $82,184 $49,671 $48,324

Minnesota $61,513 $54,471 $67,422 $64,278 $76,398 $65,105 $67,239 $67,026 $84,456 $80,610 $49,020 $46,942

Mississippi $61,249 $54,659 $67,164 $64,476 $75,988 $64,896 $67,087 $67,189 $84,145 $80,605 $48,850 $47,079

Missouri $60,575 $52,971 $66,354 $62,562 $75,121 $62,979 $66,184 $65,213 $83,010 $78,324 $48,364 $45,566

Montana $60,793 $50,793 $66,366 $60,041 $75,697 $60,484 $65,621 $62,601 $82,814 $75,260 $48,437 $43,658

Nebraska $61,308 $53,200 $67,149 $62,895 $76,164 $63,133 $66,875 $65,558 $84,052 $78,728 $48,864 $45,696

Nevada $65,465 $53,183 $71,373 $62,988 $82,422 $63,355 $69,816 $65,692 $89,318 $79,068 $51,601 $45,607

New Hampshire $60,753 $53,496 $66,326 $62,744 $75,636 $65,254 $65,595 $65,497 $82,765 $79,075 $48,411 $46,580

New Jersey $62,680 $47,593 $68,576 $56,840 $78,190 $58,513 $67,959 $59,515 $85,864 $72,721 $49,778 $40,588

New Mexico $61,773 $53,266 $67,597 $62,931 $76,895 $63,841 $67,117 $65,648 $84,584 $79,077 $49,162 $45,857

New York $62,385 $52,790 $68,154 $62,364 $77,893 $64,693 $67,329 $65,188 $85,213 $79,125 $49,543 $45,603

North Carolina $61,160 $53,647 $66,965 $63,282 $75,983 $63,690 $66,654 $65,944 $83,788 $79,108 $48,755 $46,209

North Dakota $61,269 $53,431 $67,087 $63,086 $76,135 $63,329 $66,767 $65,738 $83,950 $78,856 $48,830 $45,959

Ohio $61,591 $55,018 $67,445 $64,734 $76,581 $65,430 $67,102 $67,445 $84,428 $80,847 $49,052 $47,547

Oklahoma $60,723 $52,632 $66,516 $62,245 $75,332 $62,844 $66,327 $64,920 $83,223 $78,141 $48,466 $45,229

Oregon $62,560 $50,369 $68,133 $59,616 $78,390 $60,079 $66,775 $62,178 $84,989 $74,846 $49,591 $43,236

Pennsylvania $62,929 $52,894 $68,795 $62,629 $78,606 $63,563 $68,018 $65,368 $86,103 $78,903 $49,931 $45,432

Rhode Island $62,558 $56,623 $68,473 $66,440 $77,983 $69,397 $67,942 $69,390 $85,756 $83,935 $49,705 $49,313

South Carolina $61,229 $53,965 $67,095 $63,701 $76,016 $64,488 $66,907 $66,426 $84,010 $79,895 $48,820 $46,487

South Dakota $61,358 $52,625 $67,151 $62,239 $76,299 $62,833 $66,741 $64,913 $84,004 $78,132 $48,880 $45,222

Tennessee $61,686 $54,026 $67,601 $63,843 $76,655 $64,123 $67,373 $66,543 $84,683 $79,897 $49,135 $46,431

Texas $61,265 $50,752 $67,143 $60,508 $76,056 $61,022 $66,973 $63,213 $84,082 $76,589 $48,848 $43,230

Utah $63,041 $53,006 $68,851 $62,649 $78,843 $62,815 $67,899 $65,290 $86,114 $78,358 $49,985 $45,536

Vermont $62,552 $55,335 $68,418 $65,071 $78,031 $67,320 $67,771 $67,932 $85,638 $82,053 $49,684 $48,012

Virginia $61,454 $53,101 $67,237 $62,698 $76,457 $63,270 $66,771 $65,366 $84,101 $78,553 $48,940 $45,708

Washington $64,187 $51,783 $70,077 $61,031 $80,494 $61,195 $68,922 $63,565 $87,705 $76,100 $50,760 $44,618

West Virginia $61,827 $54,908 $67,693 $64,644 $76,927 $65,186 $67,298 $67,346 $84,746 $80,707 $49,211 $47,404

Wisconsin $61,313 $54,418 $67,130 $64,073 $76,201 $65,209 $66,795 $66,808 $84,003 $80,324 $48,859 $47,041

Wyoming $61,687 $53,932 $67,456 $63,505 $76,829 $63,857 $66,873 $66,145 $84,354 $79,202 $49,087 $46,535

Total Cost of Ownership over 12 Years

States

2022 Hyundai Kona

2022 Hyundai Kona

2022 Ford F-150

2022 Kia Niro

2022 Volvo XC40

2022 Nissan

12

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

Figure 6: National Average Total Cost of Ownership over Vehicle Lifetime

CONCLUSION

Many studies show that operating costs and TCO are lower for EVs. But the more relevant factor in

influencing consumer decision-making at the time of purchase is the monthly cost of paying for and owning

an EV during a period of loan repayment.

Today, EVs have higher upfront prices, leading some consumers to think owning an EV is only available to

higher-income earners. Failure to translate purchase price differences to monthly loan repayment costs

also makes purchase price differences seem greater, especially when combined with fuel and maintenance

savings. However, in many states and across multiple vehicle models today, it is cheaper to buy an EV than

a gasoline vehicle.

This analysis is good news for consumers who want protection from high oil prices, but EVs should be

available to all Americans looking to purchase a new car. The EV incentives currently under consideration

in Congress would help ensure millions more American drivers can access EVs to help families deal with

pain at the pump in nearly every state.

These impressive consumer savings are contingent on continued federal support for EV adoption, in

particular the federal tax credit of at least $7,500. GM and Tesla have already exceeded the sales cap under

this program, and Nissan and Ford will likely hit the cap this year. Without this incentive, it would cost

consumers more per month during loan repayment to purchase an EV for nearly all vehicle-state

comparisons we evaluated.

Gas

Gas

Gas

Gas

Gas

Gas

EV

EV

EV

EV

EV

EV

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

$90,000

Hyundai

Kona SEL

Hyunda

Kona Limited

Ford F-150 Kia Niro EX Volvo XC40 Nissan Versa

- LEAF

Lifetime Ownership Costs ($)

National Average Total Cost of Ownership

13

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

EV purchase costs will continue to decline over time, making their economic case even stronger.

Furthermore, because electricity prices are subject to state utility regulation, they tend to change slowly

over time, but gasoline prices are highly variable and dependent on global oil markets and volatile

geopolitics. As more Americans grapple with the high price of gasoline, continued federal policy support

for EVs will help get more people driving EVs and reaping savings the minute they drive off the lot.

1

Brennan Borlaug et al., “Levelized Cost of Charging Electric Vehicles in the United States,” Joule 4, no. 7 (July 15,

2020): 1470–85, https://doi.org/10.1016/j.joule.2020.05.013.

2

Tom Taylor and Josh Rosenberg, “Total Cost of Ownership Analysis” (Atlas Public Policy, February 2022),

https://atlaspolicy.com/wp-content/uploads/2022/01/Total-Cost-of-Ownership-Analysis.pdf.

3

“Update on Electric Vehicle Costs in the United States through 2030,” International Council on Clean Transportation

(blog), accessed April 19, 2022, https://theicct.org/publication/update-on-electric-vehicle-costs-in-the-united-states-

through-2030/.

4

Marco Miotti et al., “Personal Vehicles Evaluated against Climate Change Mitigation Targets,” Environmental Science

& Technology 50, no. 20 (October 18, 2016): 10795–804, https://doi.org/10.1021/acs.est.6b00177.

5

“New Consumer Reports Analysis Shows Rising Gas Prices Ramp up Savings for EV Owners,” CR Advocacy, accessed

April 19, 2022, https://advocacy.consumerreports.org/press_release/new-consumer-reports-analysis-shows-rising-

gas-prices-ramp-up-savings-for-ev-owners/.

6

Amol Phadke et al., “2035 The Report” (Goldman School of Public Policy, University of California Berkeley, June

2020), http://www.2035report.com/wp-content/uploads/2020/06/2035-Report.pdf?hsCtaTracking=8a85e9ea-

4ed3-4ec0-b4c6-906934306ddb%7Cc68c2ac2-1db0-4d1c-82a1-65ef4daaf6c1.

7

“Update on Electric Vehicle Costs in the United States through 2030.”

8

“As More Americans Choose EVs, Price and Range Continue to Hold Back the Market, According to New Cox

Automotive Study,” Cox Automotive Inc. (blog), accessed May 4, 2022, https://www.coxautoinc.com/news/as-more-

americans-choose-evs-price-and-range-continue-to-hold-back-the-market-according-to-new-cox-automotive-

study/.

9

“The Electric Car Consumers Want: Lower Cost, Higher Mileage,” Morning Consult (blog), February 9, 2021,

https://morningconsult.com/2021/02/09/energy-efficiency-series-electric-vehicles-consumers-polling/.

10

“Driving into Debt | U.S. PIRG,” accessed April 19, 2022, https://uspirg.org/feature/usp/driving-debt.

11

Borlaug et al., “Levelized Cost of Charging Electric Vehicles in the United States”; “Update on Electric Vehicle Costs

in the United States through 2030.”

12

“What Is a Down Payment on a Car?,” J.D. Power, accessed April 15, 2022,

https://www.jdpower.com/cars/shopping-guides/what-is-a-down-payment-on-a-car.

13

“Federal EV Tax Credit Phase Out Tracker By Automaker – EVAdoption,” accessed April 18, 2022,

https://evadoption.com/ev-sales/federal-ev-tax-credit-phase-out-tracker-by-automaker/.

14

Ronald Montoya, “How Long Should a Car Loan Be?,” Edmunds, May 1, 2013, https://www.edmunds.com/car-

loan/how-long-should-my-car-loan-be.html.

15

“Average Car Loan Interest Rates by Credit Score,” NerdWallet, accessed April 15, 2022,

https://www.nerdwallet.com/article/loans/auto-loans/average-car-loan-interest-rates-by-credit-score.

16

“Versa Configurator | Summary | Nissan USA,” Nissan, accessed April 18, 2022,

https://www.nissanusa.com/shopping-tools/build-price/c/29483/BABc5:ArKIYJw.

17

“Nissan LEAF Configurator | Summary | Nissan USA,” Nissan, accessed April 18, 2022,

https://www.nissanusa.com/shopping-tools/build-price/c/29324/BABch:AqoD5iM.

18

“FOTW #1190, June 14, 2021: Battery-Electric Vehicles Have Lower Scheduled Maintenance Costs than Other Light-

Duty Vehicles,” Energy.gov, accessed April 15, 2022, https://www.energy.gov/eere/vehicles/articles/fotw-1190-june-

14-2021-battery-electric-vehicles-have-lower-scheduled.

19

U.S. Environmental Proection Agency, “Population and Activity of Onroad Vehilces in MOVES3,” April 2021,

https://nepis.epa.gov/Exe/ZyPDF.cgi?Dockey=P1011TF8.pdf.

20

“AAA Gas Prices,” accessed April 15, 2022, https://gasprices.aaa.com/state-gas-price-averages/.

21

Borlaug et al., “Levelized Cost of Charging Electric Vehicles in the United States.”

14

EI | MOST ELECTRIC VEHICLES ARE CHEAPER TO OWN OFF THE LOT THAN GAS CARS

22

“FOTW #1047, September 17, 2018: Daily Vehicle Miles Traveled Varies with the Number of Household Vehicles,”

Energy.gov, accessed April 15, 2022, https://www.energy.gov/eere/vehicles/articles/fotw-1047-september-17-2018-

daily-vehicle-miles-traveled-varies-number.

23

Chargepoint, “Driver’s Checklist: A Quick Guide to Fast Charging,” accessed April 15, 2022,

https://www.chargepoint.com/files/Quick_Guide_to_Fast_Charging.pdf.

24

“Federal EV Tax Credit Phase Out Tracker By Automaker – EVAdoption.”

25

A. B. C. News, “US Electric-Vehicle Tax Credits Ending for New Toyota Buyers,” ABC News, accessed April 18, 2022,

https://abcnews.go.com/US/wireStory/toyota-buyers-lose-us-electric-vehicle-tax-credits-83919239.

26

“How Long Do Cars Last? A Guide to Your Car’s Longevity,” accessed April 18, 2022,

https://www.aarp.org/auto/trends-lifestyle/info-2018/how-long-do-cars-last.html.